Get in touch

Please contact us to discuss how working with Myriad can maximise and secure R&D funding opportunities for your business.

Contact usIf you’ve secured innovative grant funding and are now claiming R&D tax credits, you can secure over 2.5 times more in tax credits...

Innovation grants from places like the European Innovation Council (EIC) or the Disruptive Technologies Innovation Fund (DTIF) provide funding for innovative projects with high growth potential. Irish companies and organisations with projects considered too risky for private sector investment are often funded by these types of R&D grants.

These projects are also often eligible for R&D tax credits from Revenue. Combining innovation grant funding with R&D tax credits could easily save your company a lot of money.

But, the complexities surrounding R&D tax credit regulations mean that many businesses, that have also secured grant funding, are massively underclaiming on their R&D tax credits.

When filing their R&D tax credit claim, it’s not uncommon for generalist accountants or businesses to deduct the entire grant funding amount from their eligible R&D tax expenditure, not realising that some costs may be ineligible and therefore unnecessarily deducted.

Although you can’t claim R&D tax credits on grant-funded costs, you don’t have to deduct the entirety of the grant funding when determining what you can claim R&D tax credits for.

All you need to do is remove the grant-funded overheads (and any other ineligible R&D tax expenditure) from the grant-funded amount, so you’re only deducting the necessary grant-funded expenditure from your R&D tax credit claim.

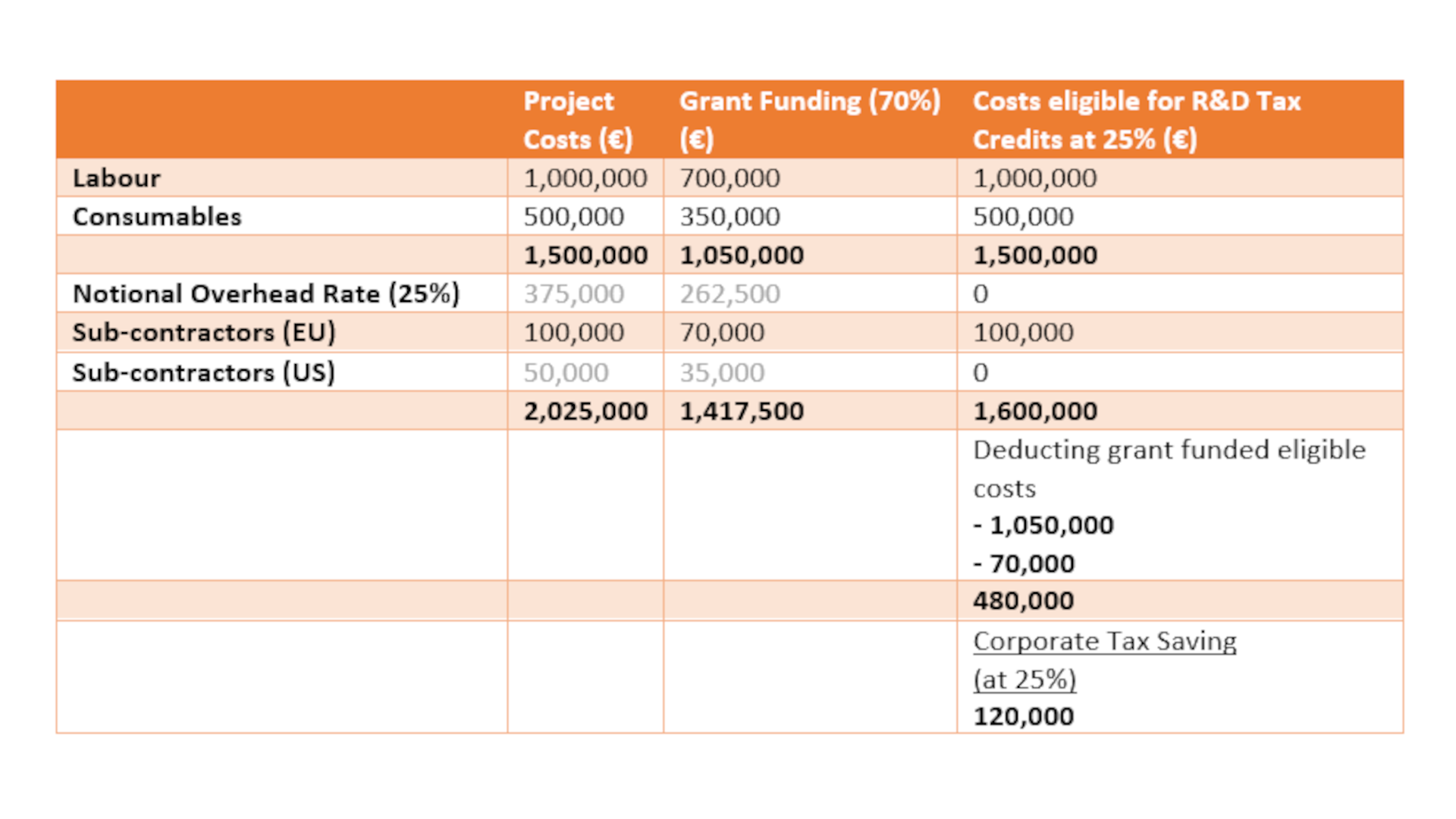

To demonstrate how this works, here’s a hypothetical project that’s been funded by the Horizon EIC Accelerator...

As you can see, the Horizon EIC Accelerator funded 70% (€1,417,500) of the project.

Like many misinformed businesses, the client might decide to deduct the entirety of the grant funding (€1,417,500) from the costs eligible for R&D Tax Credits (€1,600,000). If they do this though, they’ll only have €182,500 worth of eligible costs which, with the 25% rate for R&D tax credits, will only give them a €42,625 Corporate Tax Saving, which is just an extra 2% towards your project costs.

However, the client only deducted the following from the total costs eligible for tax credits:

They also knew that the following costs wouldn’t be eligible for R&D tax credits:

So, by deducting only the necessary costs, instead of receiving €42,625 as a Corporate Tax Saving, they’ll get a whopping €120,000 in Corporate Tax Savings, which represents 6% of the project value.

See what can be achieved when you know how?

We’ve spent over a decade in the R&D tax credit and innovation grant industry. With our experience and specialist knowledge, we can secure up to 2.6x the amount of tax credits you receive from Revenue.

To find out more, visit the website, call us on +353 1 566 2001 or drop us a message.

Please contact us to discuss how working with Myriad can maximise and secure R&D funding opportunities for your business.

Contact usMaximise your Irish Digital Games Tax Credit claim. Learn which development costs qualify for 32% relief and avoid the mistakes that trigger rejections.

Learn how to correctly claim staff costs for Ireland’s R&D tax credits, what employment expenses qualify, time-tracking rules, and compliance tips.

Irish companies can claim R&D tax credits for work in the EEA and UK. Learn the rules for foreign staff, contractors, and international R&D activities.