Get in touch

Please contact us to discuss how working with Myriad Associates can maximise and secure R&D funding opportunities for your business.

Contact usFind out how SMEs and large companies that are growing through R&D activity, can benefit financially from the RD&I fund.

The RD&I fund (Grants for Research, Development & Innovation) is an important stream of funding in Ireland, providing a substantial amount to companies developing their R&D activities, whether individually or in a collaborative project. Enterprise Ireland (EI) and the Industrial Development Agency (IDA) are behind this generous scheme, providing grant support to their current or potential clients.

Conceived to encourage investment in innovation and maintain Ireland’s position as a global leader in research and development, the RD&I fund offers additional financial support for SMEs and large companies who are growing through R&D activity. The explicit aims of the fund are to protect the futures of SMEs and increase links in the field between companies and institutions involved. Companies can expect an established budget for their R&D projects, in turn improving the culture of R&D within the business and attracting more external investment. Irish businesses can expect to use the money to facilitate growth and gain an export market share.

The exact amount of funding companies can achieve through the RD&I fund is decided on a case-by-case basis, subject to a maximum of €650,000 from EI. Companies looking to secure more than this will need to make a case for it. IDA will fund larger amounts, although the bigger the request, the longer and more challenging the assessment.

Projects centred around business innovation or agile innovation can receive a maximum of €150,000 for up to €300,000 of costs, however, the latter type of project has a shorter period of deliberation, as it is judged by Delegated Powers to Line Management rather than R&D committee.

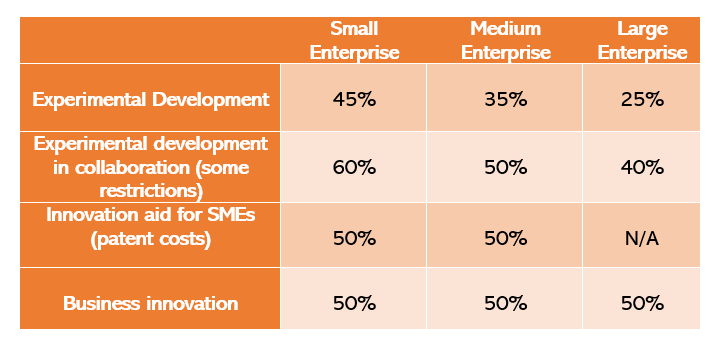

Most applications to the RD&I fund are reviewed by the R&D committee and the amount funded is determined per application. Funds can also be allocated as equity or as a convertible loan note (CLN). However, there are guidelines and maximums in place:

Applicants must be existing or potential clients of Enterprise Ireland (EI) or Industrial Development Agency (IDA), depending on whether they’re indigenous or from overseas. It’s all about growth and the company’s potential to expand its market share, especially in exports. Having approached EI or IDA about the funding opportunity, companies must also show they have the financial capability to deliver on their R&D plans as well as a positive Earnings Before Interest, Taxes, Depreciation and Amortisation (EBITDA).

The R&D activities have some requirements to meet before being accepted. They must:

Individual companies can apply, as can companies collaborating on a project and even companies within consortia in Europe, like EUREKA. Each company must make its own application and only the R&D costs incurred by the Irish company can be counted.

The RD&I Fund will fund one or more R&D projects in experiment development or business innovation, whether they have multiple phases within them or are comprised of multiple projects.

The eligible costs that can be funded by the RD&I Fund are generous. Unlike R&D tax credits, the list for qualifying expenditure is rather long, including:

Within the Enterprise Ireland scheme, the funding aims to provide support towards hiring a new ‘Key Manager’, often an R&D Manager. Under De Minimis Aid, the funding will cover one year’s salary costs at a 50% grant rate for a new externally recruited Key Manager, selected through a competitive interview process and based in Ireland.

EI and IDA invite applications to the RD&I fund on the last working day of each month. The project will be evaluated on a commercial and a technical level, working to a set of criteria that considers how crucial RD&I funding is to the project, the feasibility of the project and the previous track record of the company.

Companies must also demonstrate a clear connection between their R&D activities and commercial outputs, have established a highly-skilled R&D team, and have formed a robust system for R&D quality management. It’s all about developing a culture of innovative thinking across the organisation, which looks to harness the creativity of all its employees towards distinct business aims.

Applications are approved following the judgement of the R&D Committee in most cases, which is formed of representatives from various state agencies and the private sector, often appointed by EI or IDA. Whether going through EI or IDA the agency will assign an independent technical assessor, who is often from another state agency or an academic, who will advise the R&D Committee on eligibility and the ‘technical quality’ of the project.

Businesses who can prove that the grant aid will result in an increase in the size and scope of their projects, or that the project is dependent on the grant aid, whilst being well-balanced with technical, commercial and financial risks, are most likely to receive approval.

Having worked in the R&D and innovation grant field for over a decade, the team has built a strong relationship with EI and the IDA and know exactly what you need to do to get hold of funding for your R&D project.

Based in Dublin, Myriad Associates consists of a highly skilled team of advisors and R&D tax specialists who are experts in their field. Whether you’re a new start-up looking for funding options to grow, or you’ve been established for some time and looking to finance a specific R&D project, why not get in touch with our professional team now on +353 1 566 2001 or use our contact page.

Please contact us to discuss how working with Myriad Associates can maximise and secure R&D funding opportunities for your business.

Contact usLearn how to pass the Accounting Test for R&D Tax Credits in Ireland. Learn requirements, documentation, and get expert help to maximise your claim.

Learn how to pass the Science Test for R&D Tax Credits in Ireland and get expert tips on meeting Revenue's criteria and ensuring your R&D claim is robust.

Learn how to address R&D Aspect Queries in Ireland, clarify R&D tax credit eligibility, and respond effectively to Revenue Ireland to maximise your R&D tax credit.